Integrated Energy Portfolios

As businesses and institutions pursue cost reduction and sustainability goals, energy portfolios are becoming more complex. Long-term investments in performance contracts, renewable PPAs, conversions away from fossil fuels and increased on-site generation are changing the way energy is purchased and dramatically altering risk exposures.

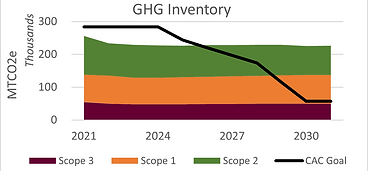

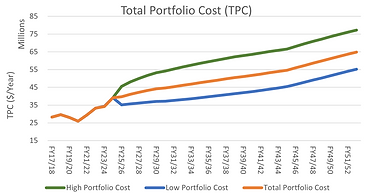

GreenSky integrates all energy transactions and investments into a single energy portfolio that provides a simple view of key performance metrics including cost trends, risk exposure, and sustainability improvements. By viewing energy as an integrated portfolio of purchases and projects, a baseline of expected performance can be established over a long-term (10 to 30-year) horizon and compared to potential portfolio changes that can deliver improvements to cost, risk, and sustainability.

An integrated energy portfolio provides all stakeholders with a common view and point of reference for consideration of long-term investments and short-term purchasing decisions. A comparison between the current baseline and future state strategies provides a clear ROI for investment decisions and incorporates the value of risk mitigation – an important value proposition that is often overlooked. Using an integrated energy portfolio, Finance, Facilities, Procurement, and Treasury can all communicate effectively and make efficient decisions on energy investments and sustainability goals.